VAT Refund

VAT (value added tax) paid on the purchase of goods and services abroad should not be considered lost because it can be reclaimed from the foreign authorities. However, applying for VAT refund across Europe poses a number of challenges. First, language can be a costly barrier while communicating with tax authorities, and the time-consuming and complicated nature of the refund process also means a high risk of mistakes, which equals: no money refunded.

This is why many companies appoint a specialized service provider like NIKOSAX to handle the VAT refund process on their behalf. Due to our longstanding experience in the management of VAT claims, we have extensive knowledge and the most recent information on all relevant legislation.

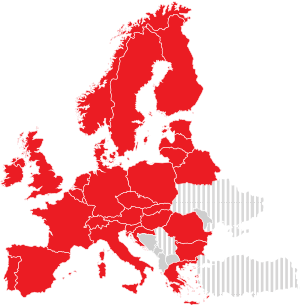

NIKOSAX makes reclaiming VAT from all EU countries and selected non-EU countries seamless and convenient for your firm so that you can focus on your core business.

Learn more about the service

Member States of Refund – MSR

Belgium

Belgium Bulgaria

Bulgaria Austria

Austria Switzerland

Switzerland Czechia

Czechia Germany

Germany Denmark

Denmark Spain

Spain Estonia

Estonia Finland

Finland France

France Great Britain

Great Britain Greece

Greece Croatia

Croatia Hungary

Hungary Ireland

Ireland Italy

Italy Lithuania

Lithuania Luxembourg

Luxembourg Latvia

Latvia Netherlands

Netherlands Norway

Norway Poland

Poland Portugal

Portugal Romania

Romania Slovakia

Slovakia Slovania

Slovania Sweden

Sweden

Goods and services for which paid VAT is refundable include (among others): diesel / gasoline, lubricating oil, coaches and truck wash, repair services, spare parts & accessories, road maps, parking fees, hotel accommodation, taxi / car rent, communication costs (telephone / fax), and meal allowances.

So why should you trust NIKOSAX to reclaim your VAT?

• We have been at it for 50 solid years and have grown our customer base in a continuously progressive manner. The continued loyalty of our over 6000 customers is a clear testament of our professionalism.

• Every improvement in our VAT refund service has been customer-driven. By putting customer needs foremost, we have operationalized digitization of our processes through OCR system to achieve industry best refund processing speeds.

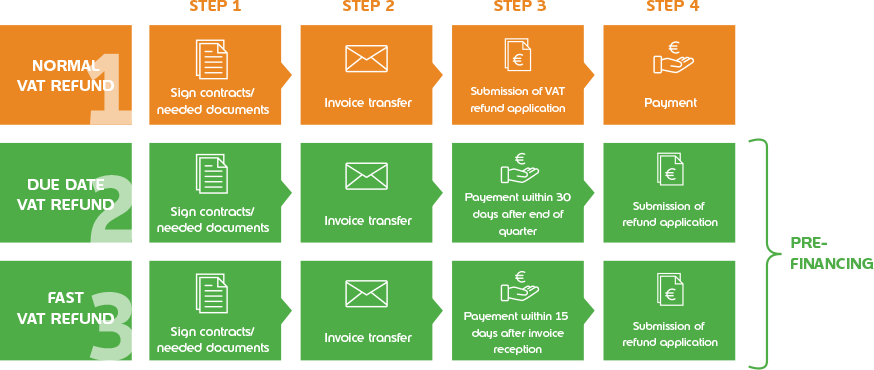

• Aside the advantage of our competitive and flexible pricing, as a VAT refund customer you have access to a cheaper funding source independent of the banks. You have the option of getting your money as fast as 15 days after submitting invoices – that is even before refund applications are sent out.

• Our customers are happy because we always ensure process transparency by giving them regular status reports on claims. We also give them prompts to make sure they don't miss any opportunity to reclaim VAT wherever its possible.

• We speak in the native language of the tax authorities and have been in touch with them for 50 years so your refund applications are in good hands.

• We GUARANTEE you the refund*

*if only all procedures are met